Here is a video I found on the net on how to age gracefully.

At the end of the day, do what you want to do, after all nobody knows what the hell they are doing!

Here is a video I found on the net on how to age gracefully.

At the end of the day, do what you want to do, after all nobody knows what the hell they are doing!

The city may soon get a 24-hour helpline for senior citizens in an initiative taken up by Young Men’s Christian Association (YMCA), in association with Sneha Sandhya and HelpAge India.

The city may soon get a 24-hour helpline for senior citizens in an initiative taken up by Young Men’s Christian Association (YMCA), in association with Sneha Sandhya and HelpAge India.

The helpline at the YMCA, a first-of-its-kind initiative in the city, will provide medical assistance and emotional support for senior citizens. “We have discussed the issues raised by senior citizens with the YMCA management, who have shown their eagerness to come up with the much-needed helpline. The facility will be launched by the end of the month,” Ch. Venkat Rao, secretary of Sneha Sandhya, told The Hindu .

Sneha Sandhya, which has a membership base of over 500 senior citizens, is also planning to establish a day-care centre for the elderly. “We have approached government officials to look for a suitable land to build the facility. With growing issues concerning senior citizens, geriatric support systems are the need of the hour,” Mr. Rao said.

At present, Sneha Sandhya has a centre at Prema Samajam, where it offers yoga training and free medical check-up.

At a time when there is a severe disconnect between the youth and senior citizens, HelpAge India, Sneha Sandhya, AU-NCSA Centre for Gerontology, and AU Department of Social Work have joined hands to come up with a novel programme called HUG or ‘Help Unite Generations’.

As part of this, a sensitisation programme will be held at AU Platinum Jubilee Guest House on July 25 involving the youth and senior citizens.

“The programme will facilitate an interactive platform between youth and senior citizens, where the elderly can explain their expectations from the younger generations and the problems they are facing. Similarly, the youth can come up with views and suggestions to address those,” Mr Rao said.

According to a recent HelpAge India survey for ‘Elder Abuse: The Indian Youth Speaks Out’, of the 2,000 youths, including women, surveyed, 73 per cent accepted that elder abuse existed in society. However, only 4.6 per cent of them intended to report such cases to the police. Even lesser, 1.1 per cent, wanted to approach an NGO and 15.6 per cent wanted to intervene and speak to the elder about fighting abuse.

Read the full article here.

( https://www.thehindu.com/news/cities/Visakhapatnam/help-at-hand-for-the-elderly/article7459558.ece )

As per the ‘State of India’s Elderly-2014’ report by HelpAge India, the country has 100 million elderly and by 2050 the figure is likely to triple to 324 million.

As per the ‘State of India’s Elderly-2014’ report by HelpAge India, the country has 100 million elderly and by 2050 the figure is likely to triple to 324 million.

“But there are not enough dependable community support systems matching this growth,” said Mathew Cherian, Chief Executive Officer of HelpAge.

Justice Leila Seth, Chief Guest at the occasion, said “neglect, poverty and isolation” were the major issues affecting the elderly people.

“The elderly population is subjected to neglect and isolation. Losing one’s dignity can harm you more than ageing. Lack of love can be a bigger evil than lack of laws to protect you.

“Though elderly continue to face troubles across various strata, the problem worsens when poverty is thrown in,” she said.

The report also talked about the need for an effective pension system. “We have been fighting to regulate the pension system nationally with the introduction of universal pension, but it is a long road ahead vis a vis implementation,” said Cherian.

“We have approached Finance Minister Arun Jaitley for the budgetary support to the segment ahead of the Budget Session,” he said.

The report states that the ongoing National Programme for Health Care for Elderly is being implemented in only 13 out of the around 600 districts of the country.

Read the original article here.

We can all agree that it’s a great feat to live to be 100 — but it’s an even greater feat if you live well, well past it. Believe it or not, the five oldest people in the world today were all born in the 1800s! These supercentenarians, as they’re called, have lived through world wars, the sinking of the Titanic, the space race and much much more.

Read the original article here.

In a role reversal, a few seniors in Besant Nagar are caring for youngsters. L. KANTHIMATHI on their initiatives in The Hindu.

We tend to picture senior citizens as helpless and leaning heavily on others. And therefore, we are surprised when we see them serve people considerably younger than themselves.

And I should admit I was more than surprised to discover such a group of seniors in Besant Nagar.

Senior Citizens Group of Besant Nagar, founded in 2012, collects and distributes books to college students. Chandrasekhar, honorary president of the forum, says, “We sent a press release about our initiative to neighbourhood tabloids and made a few calls — that’s all it took to get started. Many came forward to donate their books. Many students from families with low incomes came to receive these free books.”

To read more go here.

I am a Family Caregiver living in Abhiramapuram and my mother and I take care of my elderly grandmother. My grandmother has some challenges with mobility and with moving her right arm as she is a stroke survivor, but she manages quite well and is very lively.

I am a Family Caregiver living in Abhiramapuram and my mother and I take care of my elderly grandmother. My grandmother has some challenges with mobility and with moving her right arm as she is a stroke survivor, but she manages quite well and is very lively.

This Diwali, as per the custom each year, we wanted to make sure that my grandmother had a new dress to wear to celebrate the day. She usually wears nightdresses along with a towel or dupatta around her neck. We had purchased a beautifully designed nightdress from the Cocoon collection at the Old is Gold Store before Diwali, and knew we wanted to get her a new one from the same collection.

We love this line of clothing for her because the shoulder buttons and roomy size of the dress make it easy for her to put on because she does not need to lift both hands or struggle to have it fit over her healthy frame.  The length of the dress is also slightly shorter, so we don’t have to worry about her tripping over it when we are helping her to move from the bed to her chair. Previously we had to hem all nightgowns, but this one seems to really be made with our needs in mind. Sometimes during Diwali we reminisce on how she used to wear beautiful saris and feel a bit sad that we cannot buy her one to wear. But, from our previous experience with a Cocoon nightgown, we know it looks and feels like a high quality garment, so it made us feel like we are giving her something nice in lieu of a sari like the old days.

The length of the dress is also slightly shorter, so we don’t have to worry about her tripping over it when we are helping her to move from the bed to her chair. Previously we had to hem all nightgowns, but this one seems to really be made with our needs in mind. Sometimes during Diwali we reminisce on how she used to wear beautiful saris and feel a bit sad that we cannot buy her one to wear. But, from our previous experience with a Cocoon nightgown, we know it looks and feels like a high quality garment, so it made us feel like we are giving her something nice in lieu of a sari like the old days.

I was happy to get her one in a bold color for Diwali, because I knew it would be an item we could purchase and use right away, without alteration, and she would be comfortable both putting it on and wearing it. Indeed she was delighted to wear her new dress that day and we had a wonderful celebration.

A nightdress seems like a simple thing to write about, but to us these dresses it allows us to add some variety, convenience and comfort to our lovely grandmother’s life.

This is part-III of Precautions to protect assets after death.

Leaving behind instructions to handle incapacities

Leaving behind instructions to handle incapacitiesA closed cover noted as confidential stating name and date could be kept along with will or given to a close relative or a friend after briefing the need for such requirements with a note on the following lines:

1. If I am unconscious or critically ill and revival will make me immobilized, I do not wish to be under invasive Medical / life support such as pacemaker, ventilator, but wish to leave this world naturally and peacefully. (Please do not institute any resuscitation measures).

2. In case of my suffering due to dementia I authorize Mr………………..( my son /brother-in-law/daughter/wife) to take decision on my behalf and I authorise him/her to operate my bank account and also act as my attorney to dispose /realize my assets.

Note: Your personal medical advisor may be consulted to frame the wordings to cover the content of above instructions to match the medico-legal requirements of the hospitals.

The following important areas need to be covered and documented which should assist as a ready reckoner or a guide to the successors/ family members in managing the affairs on sudden death.

Persons above sixty years or with health problems are advised to prepare a Document/Ready Reckoner of Instructions and a format is suggested in the downloadable link:

Continuing from Part – I.

Please prepare a checklist on first of January or first of April each year of various due dates for compliance and prevent any omission/loss/ inconvenence. This will not only help keep track of your compliances as you advance in age, it will be of use for your successors/relatives to take care of the responsibilities linked to assets in a systematic manner.

Note: One can include additional items to suit family/personal/business/official and other requirements.

Death is certain. When an individual dies suddenly, the family members will have to face problems if the individual, in anticipation of death, has not taken precautions and made arrangements to settle his affairs. While appreciating the inevitable truth that Death is certain, one also needs to understand and execute his responsibilities in anticipation of the event in the best interest of his loved ones and dependents.

Death is certain. When an individual dies suddenly, the family members will have to face problems if the individual, in anticipation of death, has not taken precautions and made arrangements to settle his affairs. While appreciating the inevitable truth that Death is certain, one also needs to understand and execute his responsibilities in anticipation of the event in the best interest of his loved ones and dependents.

Death could occur suddenly by accident, heart attack and so on or a person could become incapacitated, unconscious and unable to speak or function. While we pray that such a situation should not come to anybody, every prudent person should take precautions to explain all his ideas, position of assets, relationship with family members, financial details and other vital information and inform his family members and close friends so that the affairs and assets are properly managed. This responsibility is beyond writing a clear, complete and legally valid Will. Despite the will, there are likely situations that the successors, being unable to know details and whereabouts of assets, tend to lose the wealth and land in unwarranted hardships. What was earned and saved becomes waste! In the hours of death and grief, they would also be facing unwarranted difficulties due to lack of information and instructions in management of affairs. To overcome such avoidable consequences the following suggestions are being shared.

It is in your best interest to follow the following points in order to keep your personal financial and legal compliance matters in an organized manner:-

a) All investments in FD, NSC, LIC policies, Bonds, Shares etc., are to be held in joint names and nominations are to be made for all such investments. It is also advisable to maintain photocopies of the documents along with an Investment Register being kept up-to-date as and when the investments undergo changes.

b) Keep a ‘Notarised’ photocopy of all the documents of immovable property. The original title deeds are to be carefully preserved. If they are very old or inherited take steps to get the name of legal representatives / beneficiaries in the revenue records. Obtain a legal opinion and keep the same along with the original title deeds to avoid difficulty in disposal because the rules and regulations are changed periodically and the same can be taken care of in time under advice of a competent advocate.

c) If there are immovable properties owned, please get the will registered with the help of an advocate. If the will is written in the handwriting of the testator the bonafides of the will cannot be disputed by the legal representatives. Please confirm that such handwritten will bears date and signature of the testator and two witnesses. It is advisable to choose family doctor and another person known to the family as witnesses to the will. Younger person as witness is preferred. Witness should be of good integrity to stand by the will if such need arises.

d) To avoid litigation for succession by questioning the will, Settlement of property retaining the life estate is advisable. Stamp duty for such instrument is at a concessional rate in some states.

e) A person living in isolation without spouse or issues will have to plan properly the disposal of their assets and belongings in advancing age and when they fall sick or have irreversible health problems.

f) Make it a practice to keep all important documents, title deeds of property, jewellery, FDs, Shares, Deeds, LIC policies other financial instruments and valuable assets in a safe place and periodically brief about the same to the close persons in the family.

g) If adequate precaution is not taken to enable the successors/beneficiaries to realize and enjoy the hard earned wealth, time and energy will be wasted in litigation besides delay in encashment of investments.

Source: The above article is Published in the Journal of August 2014 by Kanara Chamber of commerce & Industry

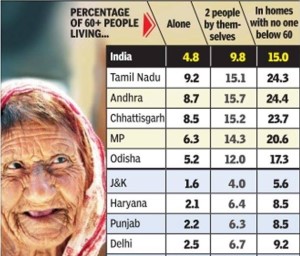

Almost 15 million elderly Indians live all alone and close to three-fourths of them are women. In some states like Tamil Nadu the proportion of such ‘single elders’ is even higher with one in eleven of those aged above 60 living alone. One in every seven elderly persons in India lives in a household where there is nobody below the age of 60. In states like Andhra Pradesh and Tamil Nadu, a quarter of the elderly population lives in such all-elderly households.

Almost 15 million elderly Indians live all alone and close to three-fourths of them are women. In some states like Tamil Nadu the proportion of such ‘single elders’ is even higher with one in eleven of those aged above 60 living alone. One in every seven elderly persons in India lives in a household where there is nobody below the age of 60. In states like Andhra Pradesh and Tamil Nadu, a quarter of the elderly population lives in such all-elderly households.

This was revealed in Census 2011 data on the number of elderly people (above 60 years) and household size released this week. Of the nearly 250 million households in India, 31.3% have at least one elderly person. If we take away those elderly living alone or in elderly-only households from this number, just over 27% of households or 68 million households have elderly living with younger members. In almost 70% of households there is nobody above the age of 60.

To read the original article in the Times of India, go here. ( https://timesofindia.indiatimes.com/india/15-million-elderly-Indians-live-all-alone-Census/articleshow/43948392.cms )