Hearing issues are often neglected. And if not rectified in time, hearing problems can get worse, so much so that one might lose ones hearing completely.

Hearing issues are often neglected. And if not rectified in time, hearing problems can get worse, so much so that one might lose ones hearing completely.

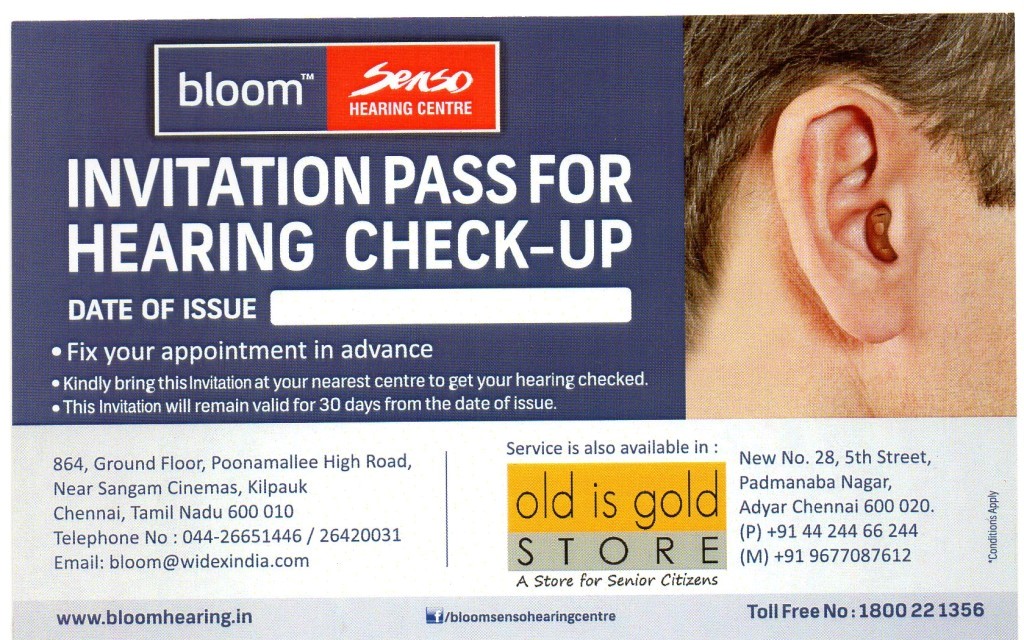

We, at Old is Gold Store, understand the importance of preserving each of our faculties and senses. To help our customers take the first step, we have arranged for free hearing test. To avail this, please call us at 044 244 66244.

To help senior citizens to step into life with second career options after retirement, the West Bengal Housing Infrastructure Development Corporation (WBHIDCO) is holding a senior citizen mela to help them train and choose career options.

To help senior citizens to step into life with second career options after retirement, the West Bengal Housing Infrastructure Development Corporation (WBHIDCO) is holding a senior citizen mela to help them train and choose career options. Lifestyle changes with age and so does aspirations. In this case, you have to take a special review of your insurance portfolio, especially after 50 years of age. There are many people who buy different types of insurance policies during their young age. That’s good and it helps in developing a sizeable corpus along with protection against risks.

Lifestyle changes with age and so does aspirations. In this case, you have to take a special review of your insurance portfolio, especially after 50 years of age. There are many people who buy different types of insurance policies during their young age. That’s good and it helps in developing a sizeable corpus along with protection against risks. The Allahabad High Court (HC) has asked the Uttar Pradesh government to expedite the formulation of rules for the safety of senior citizens in the state.

The Allahabad High Court (HC) has asked the Uttar Pradesh government to expedite the formulation of rules for the safety of senior citizens in the state. A light-weight, portable dark grey-green chair with back support is easy to carry and deploy/fold. The chair has wide base legs that do not sink into the ground even when kept on sand. At 41 cm high, it allows a high seating comfort. Ideal to take to the beach or temple. The chair comes with 2 years manufacturer warranty and is certified to take up 110kgs of weight.

A light-weight, portable dark grey-green chair with back support is easy to carry and deploy/fold. The chair has wide base legs that do not sink into the ground even when kept on sand. At 41 cm high, it allows a high seating comfort. Ideal to take to the beach or temple. The chair comes with 2 years manufacturer warranty and is certified to take up 110kgs of weight. Health insurance is more important for the elderly than the others, for the simple reason that, as age advances, one’s vulnerability to diseases and physical conditions increases. Thus, a medical emergency could result in severe financial crisis, unless covered under a comprehensive medical insurance policy. Adding to their apathy is the fact that there are many a number of Health insurers in the country who are not happy to provide senior citizens health insurance because of the higher loss ratios.

Health insurance is more important for the elderly than the others, for the simple reason that, as age advances, one’s vulnerability to diseases and physical conditions increases. Thus, a medical emergency could result in severe financial crisis, unless covered under a comprehensive medical insurance policy. Adding to their apathy is the fact that there are many a number of Health insurers in the country who are not happy to provide senior citizens health insurance because of the higher loss ratios.