Sunil Kumar Jha, a 77-year-old retired central government employee, would heave a sigh of relief amid this scorching summer. Come April and he won’t need to visit his bank and stand in the long queue to draw his monthly pension. The State Bank of India has planned a welcome respite for the pensioners — aged 75 years or more — by delivering monthly their earnings at their doorsteps.

Sunil Kumar Jha, a 77-year-old retired central government employee, would heave a sigh of relief amid this scorching summer. Come April and he won’t need to visit his bank and stand in the long queue to draw his monthly pension. The State Bank of India has planned a welcome respite for the pensioners — aged 75 years or more — by delivering monthly their earnings at their doorsteps.

The country’s biggest bank will start this pilot project from April 1 in Kolkata. If successful, other public sector banks would follow suit, which would benefit thousands of aged and ailing pensioners all over the country.

On getting this news from TOI, Jha, who stays near Don Bosco, Park Circus, and takes a 15-minute walk to visit his branch once a month for his pension, said, “It is a great initiative.” Nearly 32,000 pensioners like Jha, who are on the wrong side of 75 in Bengal and have a pension account with SBI, can now opt for this service from April.

The unique scheme, named ‘SBI 75+’, is the brain child of SBI chairman Arundhati Bhattachrya. The chief general manager of SBI (Bengal circle), Sunil Srivastava, pointed out that this is for the first time any bank in the country has undertaken such an initiative of hand delivery of pension at the door steps of elderly people.

“The scheme would be rolled out across the country over a period of time if it is found feasible. We were working on it for a few months following instructions from our chairman. We found that a lot of pensioners are staying alone as their children are abroad for studies or work. It is really difficult for them to withdraw the pension. Their number is increasing rapidly. We have tried our best to lend our helping hand to them,” he said.

Nationally, the number of pensioners aged 75 years or more would be over five lakh for SBI alone. The total number of pensioners with SBI is over 36 lakh now. There are 2.39 lakh pensioners in Bengal who are SBI account holders. Around 14% of them are in the 75+ age bracket. “There are 17 pensioners in the 100+ age bracket as well,” added Srivastava.

Srivastava explained that SBI will publish a helpline number 9674711102 for enrolling into the scheme. Once enrolled, the bank will issue two photo identity cards for the pensioners. “One identity card will be with the customer and another with the branch. While delivering the pension, the identity cards will be exchanged. This will act as a safety net to the whole process. Our own employees will deliver the pension. We shall only charge Rs 50 for this service per transaction,” he added.

To read the original article, go here.

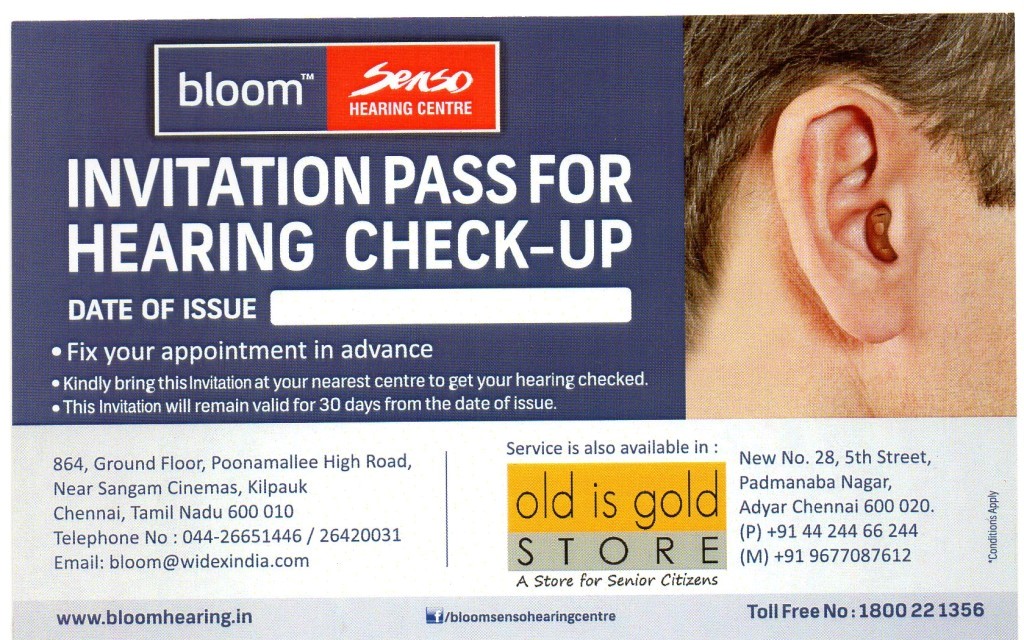

Hearing issues are often neglected. And if not rectified in time, hearing problems can get worse, so much so that one might lose ones hearing completely.

Hearing issues are often neglected. And if not rectified in time, hearing problems can get worse, so much so that one might lose ones hearing completely.

Mr. P came to our store yesterday. Since his mother’s passing 6 months ago, he had not had any reasons to come to our store, so it was a bit of a surprise for us.

Mr. P came to our store yesterday. Since his mother’s passing 6 months ago, he had not had any reasons to come to our store, so it was a bit of a surprise for us. To help senior citizens to step into life with second career options after retirement, the West Bengal Housing Infrastructure Development Corporation (WBHIDCO) is holding a senior citizen mela to help them train and choose career options.

To help senior citizens to step into life with second career options after retirement, the West Bengal Housing Infrastructure Development Corporation (WBHIDCO) is holding a senior citizen mela to help them train and choose career options. Lifestyle changes with age and so does aspirations. In this case, you have to take a special review of your insurance portfolio, especially after 50 years of age. There are many people who buy different types of insurance policies during their young age. That’s good and it helps in developing a sizeable corpus along with protection against risks.

Lifestyle changes with age and so does aspirations. In this case, you have to take a special review of your insurance portfolio, especially after 50 years of age. There are many people who buy different types of insurance policies during their young age. That’s good and it helps in developing a sizeable corpus along with protection against risks.