This is part-III of Precautions to protect assets after death.

Leaving behind instructions to handle incapacities

Leaving behind instructions to handle incapacities

A closed cover noted as confidential stating name and date could be kept along with will or given to a close relative or a friend after briefing the need for such requirements with a note on the following lines:

1. If I am unconscious or critically ill and revival will make me immobilized, I do not wish to be under invasive Medical / life support such as pacemaker, ventilator, but wish to leave this world naturally and peacefully. (Please do not institute any resuscitation measures).

2. In case of my suffering due to dementia I authorize Mr………………..( my son /brother-in-law/daughter/wife) to take decision on my behalf and I authorise him/her to operate my bank account and also act as my attorney to dispose /realize my assets.

Note: Your personal medical advisor may be consulted to frame the wordings to cover the content of above instructions to match the medico-legal requirements of the hospitals.

Instructions to handle sudden death:

The following important areas need to be covered and documented which should assist as a ready reckoner or a guide to the successors/ family members in managing the affairs on sudden death.

Persons above sixty years or with health problems are advised to prepare a Document/Ready Reckoner of Instructions and a format is suggested in the downloadable link:

Leaving behind instructions to handle incapacities

Leaving behind instructions to handle incapacities

Death is certain. When an individual dies suddenly, the family members will have to face problems if the individual, in anticipation of death, has not taken precautions and made arrangements to settle his affairs. While appreciating the inevitable truth that Death is certain, one also needs to understand and execute his responsibilities in anticipation of the event in the best interest of his loved ones and dependents.

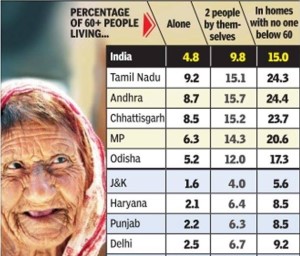

Death is certain. When an individual dies suddenly, the family members will have to face problems if the individual, in anticipation of death, has not taken precautions and made arrangements to settle his affairs. While appreciating the inevitable truth that Death is certain, one also needs to understand and execute his responsibilities in anticipation of the event in the best interest of his loved ones and dependents. Almost 15 million elderly Indians live all alone and close to three-fourths of them are women. In some states like Tamil Nadu the proportion of such ‘single elders’ is even higher with one in eleven of those aged above 60 living alone. One in every seven elderly persons in India lives in a household where there is nobody below the age of 60. In states like Andhra Pradesh and Tamil Nadu, a quarter of the elderly population lives in such all-elderly households.

Almost 15 million elderly Indians live all alone and close to three-fourths of them are women. In some states like Tamil Nadu the proportion of such ‘single elders’ is even higher with one in eleven of those aged above 60 living alone. One in every seven elderly persons in India lives in a household where there is nobody below the age of 60. In states like Andhra Pradesh and Tamil Nadu, a quarter of the elderly population lives in such all-elderly households. The Global AgeWatch Index 2014 has ranked India a lowly 69th among 96 countries it has ranked on how friendly the countries are for senior citizens.

The Global AgeWatch Index 2014 has ranked India a lowly 69th among 96 countries it has ranked on how friendly the countries are for senior citizens. A lot of activities are being planned by various organizations during the first week of October in view of the Elders’ day.

A lot of activities are being planned by various organizations during the first week of October in view of the Elders’ day. Bhiwadi – NCR township on NH 8 is all set to host 2 days senior citizen sports and culture activities. ‘Jashan’ as the event titled, is a unique initiative by Active senior living a retirement housing venture of Ashiana Housing Limited. The 2 days extravaganza on will take place on Sep27- 28, 2014 will witness participation of over 500 Senior citizens from Jaipur and Lavasa retirement communities. Some of the key sports activities being took place during ‘Jashan’ will be table tennis tournaments, badminton, chess, a mini marathon besides sports activities there are competitions like flower arrangements, salad making singing, dancing. On the second a glittering ramp show, showcasing the theme of Bride & Groom will be organised where senior citizen will walk the ramp.

Bhiwadi – NCR township on NH 8 is all set to host 2 days senior citizen sports and culture activities. ‘Jashan’ as the event titled, is a unique initiative by Active senior living a retirement housing venture of Ashiana Housing Limited. The 2 days extravaganza on will take place on Sep27- 28, 2014 will witness participation of over 500 Senior citizens from Jaipur and Lavasa retirement communities. Some of the key sports activities being took place during ‘Jashan’ will be table tennis tournaments, badminton, chess, a mini marathon besides sports activities there are competitions like flower arrangements, salad making singing, dancing. On the second a glittering ramp show, showcasing the theme of Bride & Groom will be organised where senior citizen will walk the ramp. Earlier today, we addressed a ladies club at a defence colony in Chennai. The purpose of the meeting was two-fold, one to tell them about the products we have and the other to get suggestions of products they may want us to deal with.

Earlier today, we addressed a ladies club at a defence colony in Chennai. The purpose of the meeting was two-fold, one to tell them about the products we have and the other to get suggestions of products they may want us to deal with. Kungumam – A Tamil Magazine brings out another magazine/supplement called Thozhi and they recently brought out an Independence Day issue covering many aspects of senior life in India.

Kungumam – A Tamil Magazine brings out another magazine/supplement called Thozhi and they recently brought out an Independence Day issue covering many aspects of senior life in India.

SAMBALPUR: In a bid to provide safety to elderly citizens, who are becoming easy target of criminals, SP Prateek Mohanty launched a Senior Citizen Security Cell here on Tuesday.

SAMBALPUR: In a bid to provide safety to elderly citizens, who are becoming easy target of criminals, SP Prateek Mohanty launched a Senior Citizen Security Cell here on Tuesday.